Great Pricing is Consistent, Transparent, and Fair

This is a guest post by Steven Forth Co-Founder at Ibbaka Performance.

Pricing is often thought of as a transactional part of business. Two parties get together and negotiate a price they can both live with. Done. Move on to the next deal. This is why the strategic nature of pricing decisions gets little attention at most companies. It is cut off from how the business operates.

The truth is different. Each price transaction is like a dot of paint in a painting by Georges Seurat. It is part of a larger pattern, and that pattern describes the business itself.

What kind of business do you want to be? The way you price says a lot: not just about value, but about your values.

Good pricing is fair, consistent, and transparent. These may not be the words that you associate with pricing. Still, they are the foundations of any sustainable pricing strategy, and companies that do not pay attention to this will get themselves in trouble. In our highly connected world, the operating assumption should be that anything you do not want people to know, they will find out. Assume that your competitors and customers all know your pricing and are discussing it amongst themselves.

Let’s look at each of these words in turn and see what they mean in the context of pricing.

Consistent

Pricing is consistent when the same pricing method and rules are applied to all customers. This does not mean that everyone should get the same price. There are many reasons why customers get different prices for essentially the same service.

There may be differences in how much value different customers will receive from a product or service. The principle of value-based pricing is that price is based on the value delivered relative to the next best competitive alternative. If the value is different, the price may be different. If the alternative is different, the price could be different again.

How can you tell if your pricing is consistent?

Take your pricing model and discount policy and see if they predict the prices people are actually paying. In most cases, they do not. A perfect correlation will only be found at companies that price through the website, with no exceptions, and do not play around with their prices. These are very few companies. And perfect predictability is not the goal. All systems have some noise, and a bit of noise gives some needed flexibility. With flexibility comes resilience. Letting individual sales reps price within narrow pricing corridors is often a good idea.

Dick Braun, Vice President of Pricing at Parker Hanifin, is one of the most effective pricing leaders in the world. He may be in an old school, heavy industry, business, but it is a very sophisticated one. He requires his pricing managers to create a Segmented Price Variance Analysis each month. At Ibbaka, we call these Price Dispersion Charts. The Y-axis is the price actually charged, and the X-axis is your pricing metric(s). You can learn more about these charts and how to use them here.

A typical SePVA or Price Dispersion Graph

When we do this with our customers, we typically find the fit for the curve somewhere between 70% (acceptable) and 30% (terrible). It is hard to improve pricing if it is not consistent. And consistency is an important aspect of fairness.

Transparent

Transparent pricing is the subject of a lot of debate among marketing and pricing professionals. Ibbaka organized a round table on this earlier in the year with Xiaohe Li, Stella Penso, Kyle Westra.

Should you publish your prices? Not always. For companies with dynamic pricing, where market conditions or estimations of willingness to pay (WTP), it is impossible to publish prices. In this case, pricing transparency means explaining how prices are set. In today’s world, that means explainable AI or xAI, something attracting a lot of attention these days (see DARPA’s excellent introduction to xAI).

Some companies do not even share prices internally and how pricing is set seems like a dark art to their sales and even their product teams. If your own people are not trusted to understand how and why prices are set, you will struggle with pricing fairness.

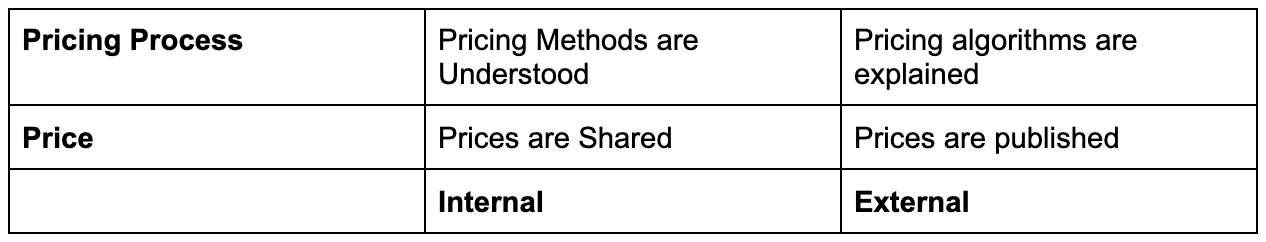

Almost all companies will want to have internal pricing transparency in terms of price and pricing process. The external approach to pricing transparency will depend on the business and pricing model. Still, it should assume that your competitors and customers know your prices (or will find out) and that you want to be shaping the conversation and not responding to it.

Fair

Fair pricing is table stakes in today’s markets. Companies that are thought to take advantage of their customers are punished and open opportunities to competitors. The most important determinant of market acceptance of pricing changes is that they are seen to be fair.

To be fair, prices need to be consistent. Learning that someone else got a better price or avoided a price increase that you accepted can be infuriating.

The process used to introduce and explain the price increase also contributes to a perception of fairness. Giving customers lots of warning, engaging in conversations with them, giving them options can all contribute to fairness.

The most important aspect of fairness turns on the value a solution provides. This is why the value creation cycle begins with creating value and goes on through communication, delivery, documentation and only then capture value (through price).

Putting price in the context of value is the foundation of fair pricing. Companies need tools to support the value cycle. These tools should be designed from the customer’s point of view; the customer decides if your pricing is fair.

An important part of pricing fairness is the value ratio. Basically, this is the value provided to the customer over time (V2C) relative to the lifetime value of the customer (LTV). V2C must be larger than LTV. How much larger? That is a strategic question and depends on your approach to the market and the maturity of the market. A good rule of thumb to get started is that the ratio should be 3:1, with the value to the customer being at least 3X the value captured by the seller.

A Simple Checklist on Consistent , Transparent & Fair Pricing

Consistent

❏ Similar customers get the same price.

❏ Your pricing model predicts actual prices.

❏ The same pricing principles are applied over time.

(Changing your pricing principles means changing your values.)

Transparent

❏ Your employees can explain how and why prices are set.

❏ Your employees can explain the pricing.

❏ Customers understand how and why prices are set.

Fair

❏ Similar customers get the same price (note the repetition).

❏ Customers get roughly the same value ratio.

❏ The value ratio allows both parties to reinvest in their business.